How Banking Transform Through Artificial Intelligence

80% Banking use AI in their work. Artificial intelligence is transforming in banking everything from customer service to fraud detection. This article will explore the benefits and challenges of integrating AI into banking, as well as what the future holds for this technology. By the end, you’ll understand how these advancements could impact your financial dealings and what you should keep an eye on moving forward.

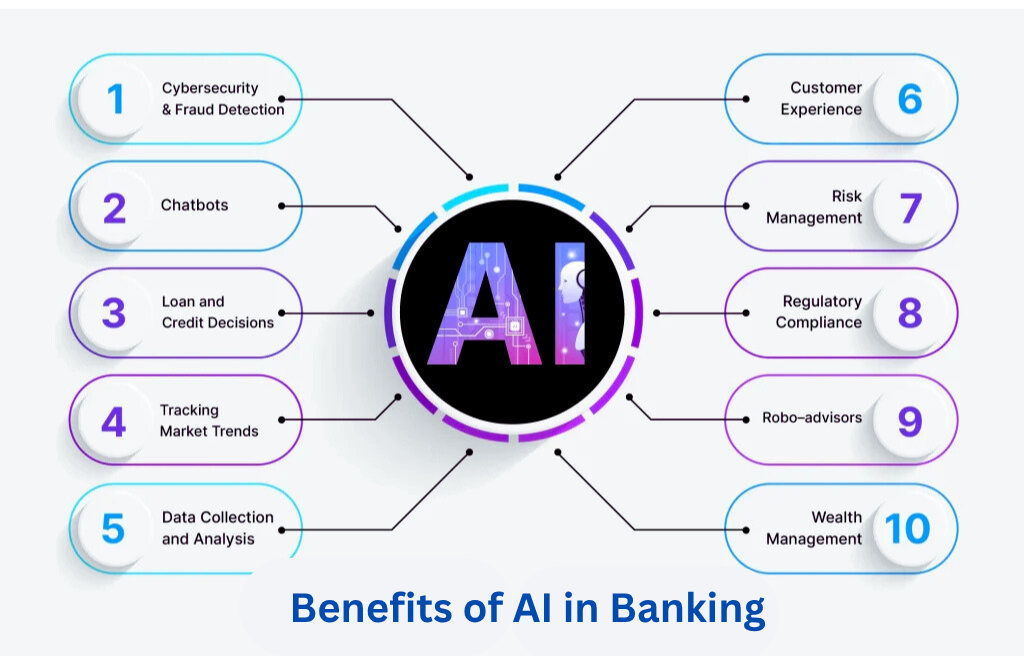

Benefits Of AI In Banking

As banks increasingly adopt AI technologies, they are unlocking new opportunities for efficiency and customer satisfaction.

Cybersecurity & Fraud Detection

Artificial Intelligence (AI) is transforming the banking industry in many exciting ways. One of the most significant benefits is in cybersecurity and fraud detection. Banks handle vast amounts of sensitive data, making them prime targets for cybercriminals. AI can analyze patterns in transactions to quickly spot unusual activities that might indicate fraud. It can analyze massive amounts of data to spot patterns and detect anomalies that might indicate a cyber threat.

For example, if someone suddenly tries to withdraw a large sum from an account in a different country, AI can flag this activity for review. This helps banks act fast and protect their customers’ money.

Moreover, AI systems continuously learn from new data, improving their ability to detect threats over time. This means that as fraudsters develop new tactics, AI can adapt and stay one step ahead.

Loans & Credit Decisions

The banking industry is changing a lot because of artificial intelligence (AI). Banks can now use smart algorithms to quickly analyze large amounts of data. This helps them make better decisions about loans and credit.

AI assesses a person’s creditworthiness faster than traditional methods. It considers factors like spending habits, income, and social media activity. This enables banks to provide loans to customers who might have been ignored before.

AI also helps detect fraud by spotting unusual patterns in transactions. This protects the bank’s assets and keeps customers’ money safe.

Additionally, AI chatbots are improving customer service. They can instantly answer questions about loans and credit, making the process easier for everyone.

Overall, AI is changing how banks work, leading to quicker decisions and better customer experiences. The future of banking looks bright with these advancements.

Tracking Market Trends

Artificial intelligence (AI) is transforming banking in exciting ways. One key change is how banks monitor market trends. AI helps banks quickly analyze large amounts of data, allowing them to understand customer behavior and market needs.

For instance, AI can track social media and news to identify new trends. This real-time analysis helps banks adjust their strategies and services quickly, so they can better meet customer needs.

AI also improves customer service with chatbots and virtual assistants. These tools can answer questions and help with transactions anytime, making banking easier for everyone.

Overall, AI is a game changer for banks. By using this technology, banks are becoming smarter and more responsive in the fast-moving financial world.

Data Collection & Analysis

The banking industry has changed significantly with the use of artificial intelligence (AI). AI helps banks operate better and connect with customers more effectively. It allows for better data collection and analysis, enabling banks to process large amounts of information quickly. With AI analyzing customer data, banks can predict spending habits, assess credit risk accurately, and create personalized financial products. This change boosts customer satisfaction and makes operations more efficient by automating tasks that used to need a lot of human effort.

Customer Experience

One major benefit is the improvement in Customer Experience. With AI, banks can offer personalized services by analyzing customer data and preferences. This means you get recommendations tailored just for you. It also helps to build customer trust.

Overall, AI in banking is all about making things smoother and more efficient for customers. It’s a step towards a more user-friendly banking experience.

Risk Management

The banking sector is changing a lot due to artificial intelligence (AI). This technology is improving many parts of financial services, especially in risk management.

AI algorithms quickly analyze large amounts of data, helping banks spot potential risks much earlier than before. By using machine learning, banks can predict market trends and find unusual activities that could indicate financial problems.

AI also improves how banks check their customers’ identities. It automates this process, which helps reduce fraud and ensures compliance with laws. This not only boosts risk management but also makes operations more efficient.

Wealth Management

With AI, banks can analyze vast amounts of data quickly and accurately. This helps them understand market trends and make better investment decisions for their clients. AI in banking wealth management is revolutionizing how banks serve Pakistani clients 🇵🇰. It offers personalized investment advice, automates portfolio management, assesses risks, and provides 24/7 customer support, leading to wealthier outcomes and happier clients.

Additionally, AI can personalize financial advice. By examining a client’s spending habits and goals, AI can suggest tailored investment strategies. This means customers get advice that fits their unique needs, making wealth management more effective.

Regulatory Compliance

AI can quickly and accurately analyze large amounts of data, which helps banks make better decisions.

AI is especially helpful for regulatory compliance. Banks must follow many regulations, and AI can automate tasks like monitoring transactions and spotting suspicious activities. This reduces human error and helps banks stay compliant with complex rules.

AI tools also provide real-time insights, allowing banks to quickly adjust their strategies when regulations change. With machine learning, banks can predict compliance risks before they become serious, enabling them to take action early.

Robo-Advisors (automated investment advisor)

These automated platforms provide personalized financial advice based on individual client profiles and investment goals.

Robo-advisors utilize algorithms to analyze vast amounts of data, authorize them to make informed recommendations for asset allocation and portfolio management. This technology not only streamlines investment processes but also reduces costs, making financial advice more accessible to a broader audience

At the result is Robo-advisors in banking, powered by AI, are totally streamlining investment advice! AI automates investment decisions, personalizes portfolios, continuously rebalances them, and lowers costs, making smarter, affordable investing a reality for clients.

Chatbots

The banking industry is changing significantly due to artificial intelligence (AI). A key development is the use of chatbots, which offer customers instant help 24/7. These AI tools can answer common questions and guide users through complicated transactions.

Chatbots improve customer experience by reducing wait times and providing personalized support. They use user data and past interactions to give tailored responses, making banking easier and more friendly. This makes customers feel valued and builds loyalty and trust in banks.

Additionally, AI is enhancing security in banking. Banks use machine learning to spot fraudulent activities in real-time, keeping customer accounts safe. This proactive approach not only protects assets but also boosts client confidence.

You can also read 70 key disadvantages of AI in banking on our website.

CONCLUSION

The benefits of AI in banking are numerous and transformative. From enhancing customer service with chatbots to improving security through advanced fraud detection, AI is reshaping the financial landscape. Banks can process data faster and more accurately, leading to better decision-making and personalized services for customers. Additionally, AI helps reduce operational costs, allowing banks to focus on growth and innovation. As technology continues to evolve, embracing AI will be crucial for banks to stay competitive and meet the changing needs of their clients. So, let’s encourage our banks to invest in AI solutions for a better banking experience!

FAQs

What is artificial intelligence (AI) in banking?

AI in banking refers to the use of computer systems to perform tasks that normally require human intelligence, like understanding customer needs, detecting fraud, and automating services.

How does AI improve customer service in banks?

AI improves customer service by using chatbots and virtual assistants that can answer questions 24/7, helping customers quickly without long wait times.

Can AI help in preventing fraud?

Yes! AI can analyze transaction patterns in real time to detect unusual activities, helping banks spot and prevent fraudulent transactions faster.

How does AI personalize banking experiences?

AI analyzes customer data to offer personalized recommendations, such as tailored financial products or customized savings plans based on individual spending habits.

What are the benefits of using AI for loan approvals?

AI speeds up the loan approval process by quickly assessing a borrower’s creditworthiness through data analysis, making it easier for customers to get loans.